Deregister from the Business Register at KVK

Do you want to end your business? You must deregister your company or organisation from the Business Register at KVK. How you deregister depends on your business structure.

Deregistering your sole proprietorship

Image deregister sole proprietorship

Image deregister sole proprietorship

You can deregister your eenmanszaak (sole proprietorship) online (in Dutch). Look up the name of the company you want to deregister in the Business Register and follow the steps.

Enter the date on which you want to end your business. This can also be a date in the past, if you have already ended your business. And if you have not reported any changes since then. You send your data digitally with DigiD.

Deregistering your sole proprietorship by post

You can also deregister your company by post. Use form 14: Business/branch details. Print the form, sign it, and send it to your regional KVK office. Include a copy of a valid ID in the envelope. For example, a copy of your passport, ID card, driver's license, or Dutch identity card for aliens. It will take around 10 work days to process your deregistration.

Note: changes when you deregister

When you deregister, this may cause changes in your bank account, insurances, pension fund, and permits. For example, if you are deregistered from KVK, you can no longer access your business bank account. Contact the organisations where you have accounts or contracts and ask them how to end your business. Also see the article Ending your sole proprietorship.

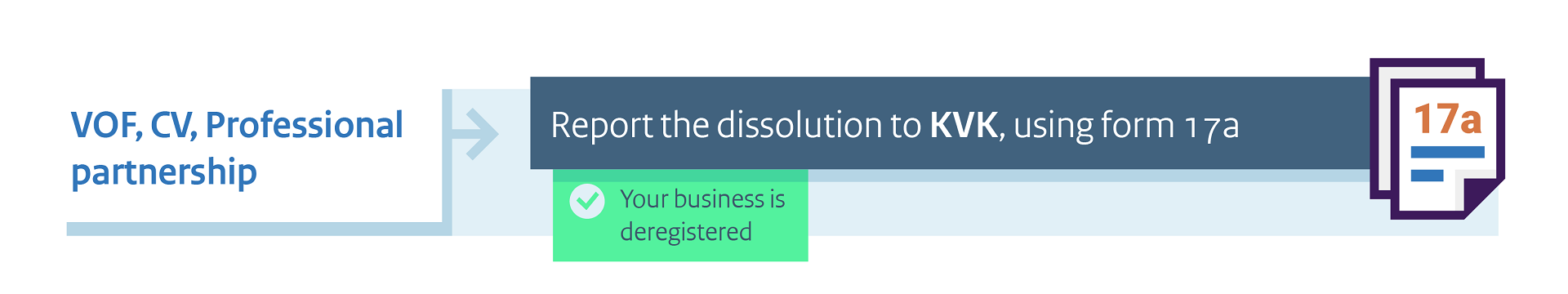

Deregistering your vof, cv, or maatschap

Image deregister vof cv or maatschap

Image deregister vof cv or maatschap

To deregister a general partnership (vof), a limited partnership (cv), or professional partnership (maatschap), you must dissolve it. You can only do so by post. You cannot dissolve or deregister your partnership online.

Print form 17a: dissolution of a company, legal entity, or partnership from the KVK website and fill it in.

Fill in the date on which you want to end the company. The end date can be a date in the past, if you have already ended doing business. And if you have not rteported any changes since that date.

Print the form and sign it. You and all other partners or ‘maten’ must co-sign at point 5.1.

Send the form to your regional KVK office with a copy of a valid proof of ID. For example, your passport, ID card, driving licence, or Dutch identity card for aliens. KVK will then deregister your partnership. The deregistration is free of charge.

Note: changes when you deregister

When you deregister, this may cause changes in your bank account, insurances, pension fund, and permits. Contact the organisations where you have accounts or contracts and ask them how to end your business. Also see the article about ending your partnershup:

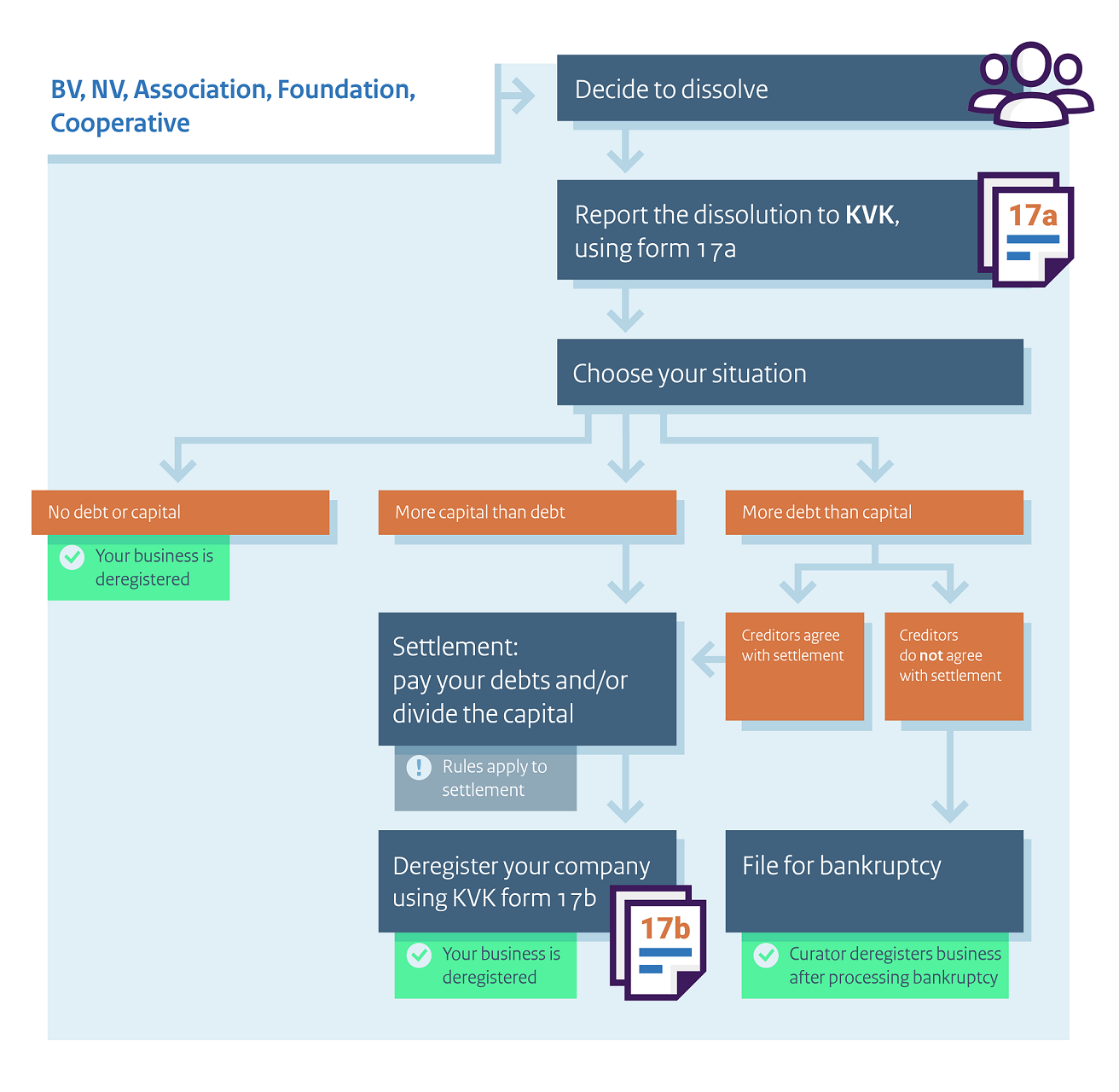

Deregistering your bv, nv, coöperatie, vereniging, or stichting

Image deregister bv

Image deregister bv

The Dutch business structures bv (private limited company), nv (public limited company), coöperatie (cooperative), onderlinge waarborgmaatschappij (mutual insurance society), vereniging (association), and stichting (foundation) are legal entities. To deregister a Dutch legal entity, you must follow these steps:

Step 1: dissolve the legal entity

You must dissolve the legal entity first. To do this, you need to take a formal decision. Who takes the decision depends on the business structure:

- In a bv or nv, the general shareholders meeting takes the decision.

- In an association, cooperative, or mutual insurance society, the members' meeting takes the decision.

- In a foundation, the board takes the decision.

The dissolution of the legal entity takes effect as soon as the decision is made, or at a future date. Read more about dissolving your legal entity.

Step 2: Report the dissolution to KVK

In that case, you can deregister the legal entity directly at KVK. Use form 17a (Dissolution of a company, legal entity, or partnership) to report the dissolution to KVK. Fill in that there are no assets. Print the form, sign it, and send it to your regional KVK office with a copy of a valid ID of the person who signed the form. After processing, your legal entity is deregistered. Deregistration is free, and can only be done by post.

Use form 17a (Dissolution of a company, legal entity, or partnership) to report the dissolution to KVK. Fill in that there are assets. Print the form, sign it, and send it to your regional KVK office with a copy of a valid ID of the person who signed the form. Your legal entity is now 'in liquidation', and not yet deregistered. Follow steps 3 and 4 to deregister.

In that case, you file for bankruptcy. After this the rules and procedures of a bankruptcy apply.

Do your creditors agree to settle the debts without a bankruptcy procedure? Then you can follow the same steps as if your legal entity had more assets than debts.

Step 3: Pay your debts and divide the remaining assets

You pay your debts and other financial commitments or you divide your assets. This is called liquidation. You must follow rules when you liquidate. The legal entity will cease to exist once it has no more assets or debts.

Read more about how to liquidate your legal entity.

Step 4: Deregister your legal entity at KVK

After you have settled your debts or divided your assets, you can deregister the legal entity. You use form 17b, Termination of a legal entity.

Print the form, sign it, and send it to your regional KVK office with a copy of a valid ID of the person who signed the form.

After processing, your legal entity is deregistered. Deregistration is free, and can only be done by post.

Note: changes when you deregister

When you deregister your legal entity, this may cause changes in your bank account, insurances, pension fund, and permits. Contact the organisations where you have accounts or contracts and ask them how to end your business.

Also see the article Checklist for ending your business to see how you can end your legal entity.

Proof of deregistration

You always receive a confirmation of your deregistration by mail. You can also order an extract from the Business Register as proof of your deregistration. Do you want to check if another company or organisation has been deregistered? You can still find deregistered organisations in the Business Register (use 'Uitgebreid zoeken', extensive search). The entry will state that the company has been deregistered from the Business Register.

You cannot put your company on hold

It is not possible to put your company on hold. When it is necessary to temporarily stop working less than 6 months on your business, for example, to study, travel, or a period of paid employment, you can keep your business registration. But if it takes longer, you should deregister. Read more about your options (see the FAQ: Can I temporarily put my business on hold?). If your company is a legal personality, you must dissolve it before you can de-register. If you want to continue with your business later, you need to register again. You will then get a new KVK number, VAT identification number and VAT tax number.

So long as your business is registered, your legal obligations continue. Depending on your legal structure, you have to file tax returns, keep business records, and file financial statements with KVK. You also have to honour any contracts with suppliers and customers you have entered into.

Deregistering a branch office or official

Do you not want to deregister your company, but a branch office or an official? Follow the steps in the (Dutch only) online forms on KVK.nl:

Or download the forms:

Do you want to deregister someone else, for example a power of attorney or UBO? Use the online change form on KVK.nl (in Dutch), or choose the right form on Forms for registration and reporting changes.

Questions relating to this article?

Please contact the Netherlands Chamber of Commerce, KVK