Dissolution of a legal entity

To end a legal entity such as a BV, NV, cooperative, association, foundation, or mutual insurance society you have to dissolve it first. How does that work?

On this page

What is dissolution?

Dissolution is one of the steps you have to take to end a legal entity. Dissolution means that all activities of the legal entity cease. A dissolved legal entity may then continue to exist temporarily to pay possible debts and sell (liquidate) its assets. Usually, dissolving a legal entity requires a resolution of dissolution from the shareholders or board members. Exactly how the process of dissolution works depends on the situation.

Different ways to dissolve legal entities

In most cases, a formal decision is required to dissolve a legal entity. Who is allowed to make that decision depends on the type of legal entity.

- Public or private limited company (NV or BV): the general shareholders' meeting takes the decision.

- Association (vereniging), cooperative (coöperatie) or mutual insurance association (onderlinge waarborgmaatschappij): the members' meeting takes the decision.

- Foundation (stichting): the board takes the decision.

The dissolution of a legal entity takes effect the moment you make this decision, or at a future time. Record this in a written board decision or in a report of the meeting at which this decision was taken. You cannot decide to dissolve the legal entity on a date in the past.

In some cases, no decision is required to dissolve an association, cooperative, or mutual insurance society. These must be dissolved immediately if they no longer have members.

In some cases, the articles of association state that the legal entity must be dissolved in the event of a specific situation. For example, if the purpose of a foundation has been achieved.

Under certain conditions, the Netherlands Chamber of Commerce KVK must dissolve empty legal entities. KVK does this if the legal entity does not comply with a number of rules. For example, there has been no director for more than a year and the legal entity has proved to be unreachable. Read more about when and how KVK dissolves a legal entity.

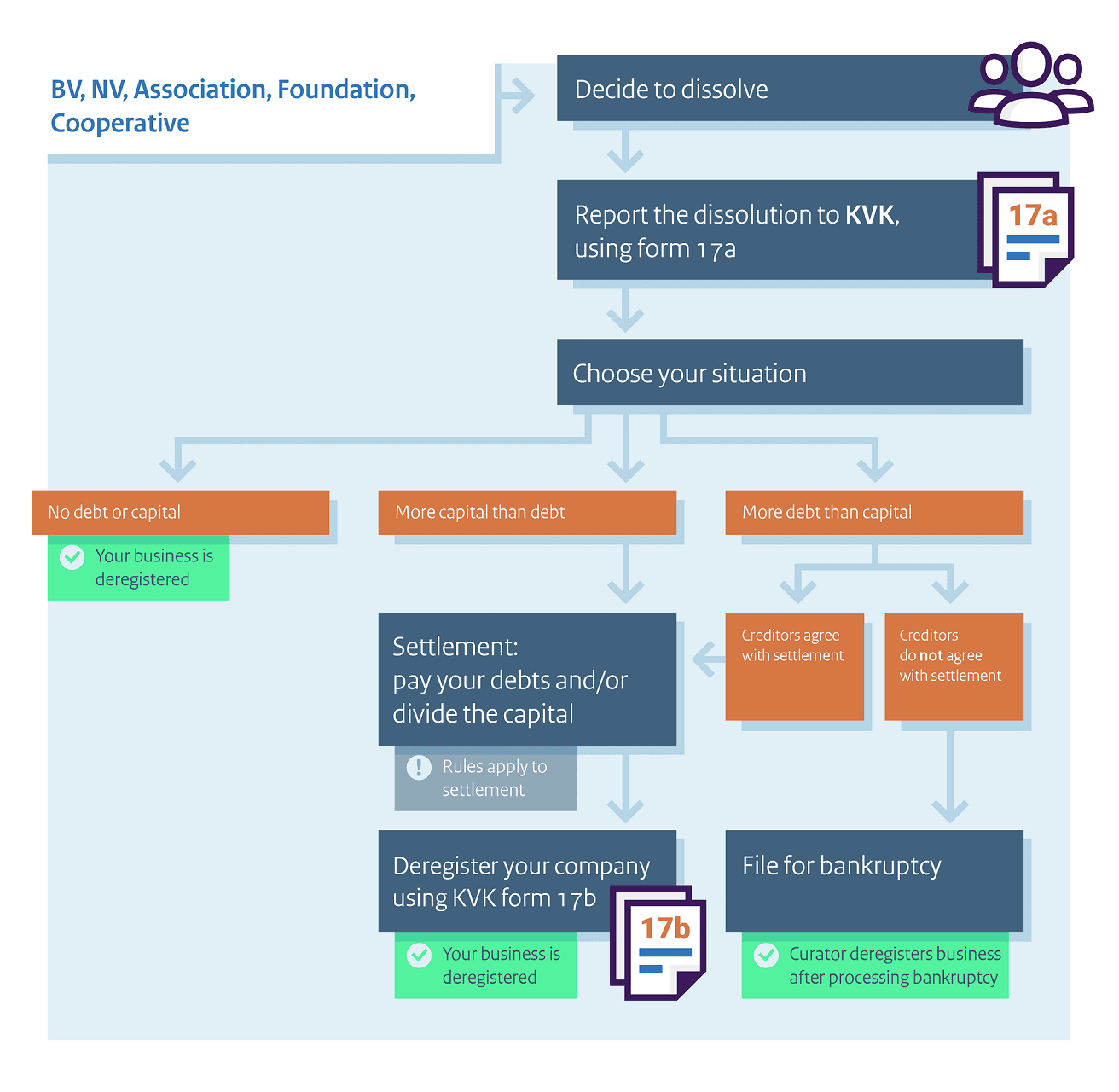

Flow chart describing the steps when dissolving a legal entity, as described in the article.

Dissolution of a legal entity is irreversible

When you dissolve a legal entity, you cannot undo it. A decision to dissolve is final. But, under special conditions, a judge can revoke this decision. The judge will check, among other things, whether the reversal does not put others at a disadvantage. Check the articles of association for agreements about the dissolution of the legal entity before you act. Consult your accountant to make sure you have not missed anything.

Report the dissolution to KVK

You do this using Form 17a: Reporting a dissolution of a legal entity, which you can download from the KVK website. To fill in the form, you need to know how many debts and assets the legal entity has.

Read more about determining your situation and dissolving a legal entity.

What happens after dissolution?

Does your company or organisation still have money or other assets? Then the legal entity goes into liquidation The legal entity continues to exist until the capital has been liquidated. You pay the debts, distribute the profits, and sell the goods and stock. There are rules you must follow for this process. After liquidation, you report the end of the legal entity to KVK.

Read more about what you have to do if you go into liquidation.

If the legal entity has more debts than assets, you can file for bankruptcy. Or you agree with creditors that you will liquidate without bankruptcy.

If you no longer have any assets in your company or organisation at the time you decide to dissolve it, then the legal entity ceases to exist at the time of dissolution. You do not then have to liquidate. This quick way of ending your company is called fast-track liquidation, also known as turbo liquidation. After the dissolution decision you report the dissolution to KVK:

- Do you want to deregister another legal person without assets? You can do so using Form 17A: Reporting a dissolution of a legal entity.

Send additional information to KVK

Since November 2023, legal entities undergoing turbo liquidation must submit additional documents to KVK These documents are intended to provide more clarity about the how and why of the 'turbo liquidation'.

Read more about the rules and risks of terminating your legal entity via fast-track liquidation.

Preprare before you dissolve your company

Dissolving and deregistering your business may affect your bank account, financing, insurance, pension fund, or municipal permits. For example, if you are deregistered from KVK, you can no longer access your business bank account. So before you deregister from KVK, consider what you need and what it could mean for you. Close bank accounts, cancel permits, and end contracts belonging to the legal entity before you deregister the legal entity.

Read the step-by-step plan for ending your business to prepare for ending your company.

Owners' association

To dissolve an owners' association (Vereniging van Eigenaars, VvE) you need to go to a notary. The notary draws up an official document (deed) stating that the association ceases to exist. You send the deed together with the form for dissolving a legal entity to KVK. The rules for a fast-track liquidation do not apply here.

Partnerships: VOF, maatschap, or CV

Different rules apply to the termination of partnerships such as a general partnership (VOF), professional partnership (maatschap) or limited partnership (CV). Partnerships are not legal entities.

Ending a sole proprietorship

A sole proprietorship is not a legal entity. You do not have to dissolve it. Read what to do if you want to end your sole proprietorship.